My teenage son had been looking to buy his first car, after a lot of research by both of us, he has bought a used Vauxhall Corsa. The main reason for getting the Corsa was not because it was the best car in terms of having good features, MPG, price etc, but because it was one of the cheapest cars for a new driver to insure.

Quick Summary

|

Insurance for New Drivers is Expensive

Unfortunately, there’s no getting away from it, but car insurance for young new drivers is not going to be cheap!

Fortunately, several UK insurers, including Admiral Insurance, offer ‘Black Box’ policies for young drivers that can help lower premiums. Sadly, I wouldn’t describe them as cheap insurance.

My son and I spent hours getting insurance quotes from various UK insurance companies and price comparison sites. There were huge variations in the quoted prices from £1000 to £8500 per year.

What You Need to Know About Car Insurance for New Drivers

Getting your first car is exciting, but for new drivers, the first shock often comes when you see the insurance quote. Premiums can vary wildly, and one of the biggest factors influencing the cost is your car’s insurance group

Cars in the UK are categorised into the following insurance groups:

Group 1: 1 to 10 – Cheapest to insure

Group 2: 11 to 20

Group 3: 21 to 30

Group 4: 31 to 40

Group 5: 41 to 50 – Most expensive to insure

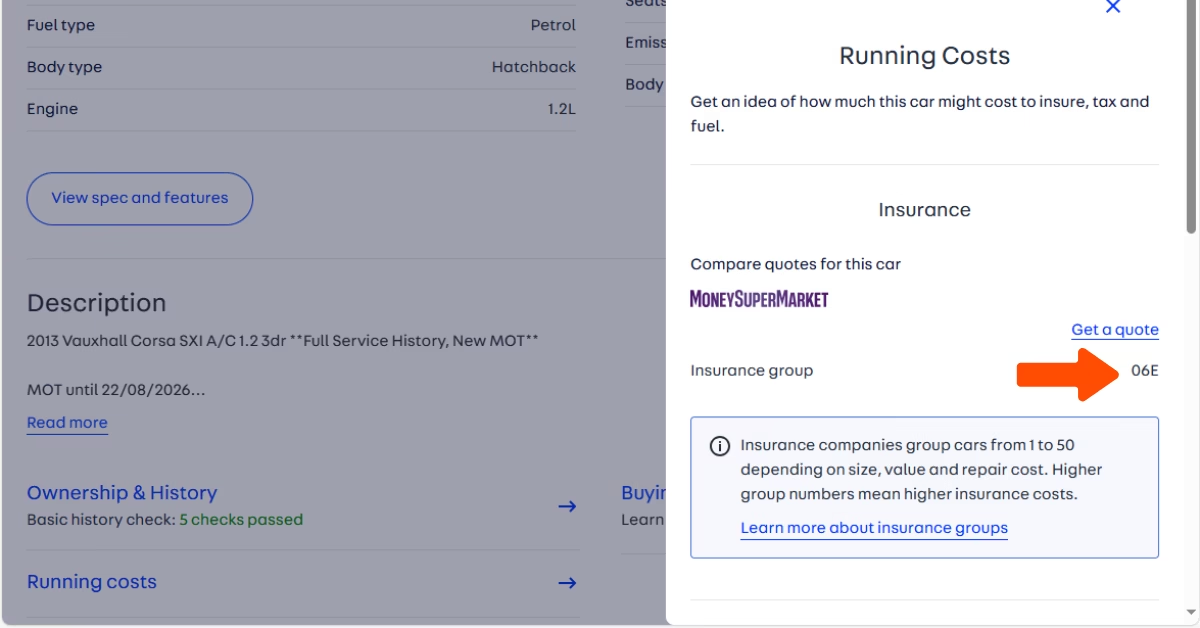

On car sales websites like Carzoo, Autotrader etc you will often see the insurance category for the car being sold.

On the Autotrader website, the insurance group is found under the ‘Running Costs’ section

The insurance group number will also have a letter at the end. The letter at the end indicates the safety level of the car.

-

A – Meets standard security requirements

-

D – Falls short on safety, placed in a higher group

-

E – Exceeds security standards, placed in a lower group

-

P – Not enough data yet; group may change later

-

U – Security rated unacceptable; may need upgrades to insure

-

G – Imported vehicle (parallel or grey import)

In theory, to get the cheapest insurance, you would want to look for a car that has the insurance group 01E. However, in practice, this isn’t the case. A car with a 10E category could be cheaper than a 01E. In fact, I found that cars in the ‘more expensive’ insurance Group 2 sometimes had lower insurance costs.

Which Cars Fall into The Cheapest Group 1 Insurance

I didn’t find a way of easily determining which insurance group a particular car model belonged to. The reason for this is that the age, engine size, safety and security features it’s kitted out with all make a difference to which insurance group the car belongs.

The cars that my son and I shortlisted because they are among the cheapest cars to insure for young drivers in the UK were (no particular order):

- Volkswagen Polo

- Hyundai i10

- Citroën C1

- Peugeot 108

- Toyota Aygo

- Fiat Panda

- Ford Ka+

- Nissan Micra

- Vauxhall Corsa

- Volkswagen Up!

We compiled this list by researching sources like the RAC, Admiral Insurance and various car industry websites that ranked the cheapest cars to insure. While many of these sites highlighted similar models, we narrowed it down to a final 10 based on practical factors including:

- Did my son like the car. He wasn’t allowed to be too fussy

- Did the car fall within the budget of £4000

- There was a decent local supply of the car model

What Makes A Car Cheaper To Insure

I found that the following things make a difference to how much a car costs to insure:

Performance – Probably the most obvious. The greater a car’s performance, the greater the risk, and so the greater the insurance cost.

Modifications – Some modifications can reduce costs e.g. car alarm; other modifications can increase costs e.g. sport suspension. Some things are considered modifications that you wouldn’t think are, for example, roof rack. A Corsa that I looked at online had a modified exhaust. The exhaust pipe looked slightly bigger than the standard manufacturer’s exhaust pipe, but that actually prevented my son from being able to get insurance for that particular car.

Car Age – This can go either way on insurance costs. New cars generally cost more to repair or replace, so they’re more expensive to insure. However, new cars usually have better safety features than older cars, which would reduce insurance costs.

Safety Features – The more safety features, the lower the premiums. Look for cars with airbags, ABS, traction control, Assistance technology, High NCAP rating etc. Choosing the safest car you can is a good idea, both for keeping insurance premiums lower and for reducing the risk of injury on the road

Conclusion

Buying my son’s first car was more about navigating the insurance maze than it was about finding the right car. While features such as fuel economy and purchase price all matter, the reality is that insurance costs can outweigh those considerations for young new drivers. Knowing about insurance groups, knowing which car models tend to be cheaper to cover, and paying attention to performance, modifications, age, and safety features, you can make a more informed choice.