After a lot of searching for young driver car insurance, my teenage son ended up going with an Admiral black box insurance policy. Since neither of us had any experience with black box insurance, we had a few concerns, especially given the fairly large number of negative reviews online. Here’s our experience with Admiral’s black box insurance.

Quick Summary

|

Buying Admiral’s Black Box Car Insurance

Buying Admiral’s black box car insurance works much the same as taking out a standard policy without a black box. As with any insurance, there are steps you can take to help bring the cost down. The key difference to keep in mind with a black box cover is that it usually comes with some limitations.

How To Reduce Insurance Premium

There are several things that you can do to help bring down the insurance premium costs. I strongly recommend that you call Admiral rather than do everything online. Do the initial quote online and then call Admiral.

1) Add an Experienced Driver To The Policy

If you’re buying insurance for a young driver, add an experienced driver as a named driver to the policy. I added myself to my son’s insurance, which reduced the premium by about £10 per month.

I don’t have any points on my licence and haven’t claimed in the last 9 years. I imagine this helped bring the cost compared to a named driver with points, and has made a claim.

2) Get Admiral Multicover Insurance

Getting Admiral multicover insurance will help significantly bring down the price of black box insurance.

At the same time as buying the black box insurance, I took out future insurance policies for my car and also house insurance. By taking out multicover insurance, I reduced my son’s black box insurance by about £20 per month.

Top Tip: You can take out Admiral Multicover insurance even if you already hold policies with another insurance provider. In my case, both my car and home insurance had around nine months left until they needed renewing.

I arranged a new cover with Admiral to begin in nine months time when my current insurance policies finish. My car and home policies would only run for three months, ending at the same time as my son’s black box policy. Even with just three months of Multicover, the cost of the black box insurance was reduced. In fact, it was reduced by the maximum amount possible by Multicover. If I had multicover for 1 year, the discount would be the same.

3) Voluntary Excess

Play around with the voluntary excess you are willing to pay. Remember, there will be a compulsory excess, so only set the voluntary at an affordable amount.

I can’t recall the exact figure, but raising the voluntary excess only lowered the premium to a point. Beyond that, there was no further saving. So don’t assume that choosing the highest excess will mean the biggest reduction in your insurance cost.

Paying a higher voluntary excess reduced my son’s insurance premium by slightly over £5 per month.

4) Pay Annually

Paying the insurance premium annually would have saved me a total of £110, compared to paying monthly. I decided not to pay annually because:

- It’s a lot of money to cough up

- It means I’m in a better position if there are any issues

5) Other stuff

There are a number of other things that are often suggested as ways of reducing costs, like:

- Getting an upgraded car security \ alarm

- Where the car is located at night

- Low estimated mileage

- Tweaking job title (also note that students and the unemployed pay more)

- Get quotes well in advance (at least 21 days before you need cover)

- Get fully comp (not third party, fire & theft)

I tried a few of the above things, but they made very little or no difference to the premium.

No Waiting: Lower Premium Starts Immediately

If you take out Black Box cover, you’ll get the discounted premium straight away. You don’t need a year of good driving before the lower rate applies. If, after a year, your driving score is good, you will get a lower insurance premium if you renew your insurance with Admiral.

Note: Unfortunately, Admiral doesn’t share whether you’ve been a good driver with other insurers, which means you will need to stick with Admiral to get the ‘good driver’ discount.

Admiral Black Box Restrictions

There are no restrictions (at the time of writing) on using the Admiral black box. The main thing to be aware of is that driving between 10:00pm and 4:00am will have a negative impact on your driving score. If you work nights, then the Admiral black box insurance is not going to be a good option. Some insurers actually prohibit driving between certain hours at night.

What Does the Black Box Monitor

Below are all the things that the Admiral black box tracks that will impact your driving score. I got this information from the Admiral website and by speaking to someone in their call centre

Speeding – how often you exceed the legal limit, not just your average speed. Admiral do not report speeding to the police.

Smoothness – harsh acceleration and hard braking, plus cornering.

Time of day – nighttime driving (10pm to 4am) is a higher risk and negatively affects your score. There is no curfew

Mileage – checks your declared annual mileage

Location data – Check your car is kept where you say it is on the insurance policy

The above are specifically for the Plug & Drive Littlebox. I would guess the engineer fitted black box and the Littlebox Pod are very similar.

Installing The Plug & Drive Self-Install LittleBox

Once you have taken out the insurance policy, you will receive the LittleBox in the post. In my case, the LittleBox arrived in 5 days.

You can drive the car before you receive the LittleBox. You will get details on the date by which the LittleBox must be installed. It’s about 2 weeks after buying the policy.

Installing the Plug & Drive Self-Install black box is super easy. It’s simply a case of plugging it into the cigarette lighter (12v) for power and then locating it in a suitable location in your car. There’s zero configuration; you don’t need to connect it to your phone or WiFi. The LittleBox comes with printed instructions explaining how to install it.

IMPORTANT: Make sure the black box is firmly fixed in place. If it moves, it could produce inaccurate sensor readings and reduce the driver’s score.

Does Admiral Black Box Have An App

No, there is no app for the self-install LittleBox to show you how well or badly you’re driving. Instead, Admiral will send an email about once a week with your driving scores.

When the LittleBox is first installed, it takes 21 days before you will receive your first email.

Admiral does have an app for general management and information about the insurance policies you have with them. I installed the app and removed it pretty quickly, as it wasn’t very useful.

If you get the LittleBox Pod black box then you will have access to an app that shows driving scoring. I was told the LittleBox Pod isn’t normally supplied to new or young drivers.

How Does Admiral Score Driving

Admiral have a good article on their website Understanding Plug & Drive feedback – Admiral, which explains what you are scored on and how the scoring works

How Strict Is Admiral Black Box Insurance

A quick look at Reddit and other forums shows mixed views on how strict Admiral’s black box monitoring can be.

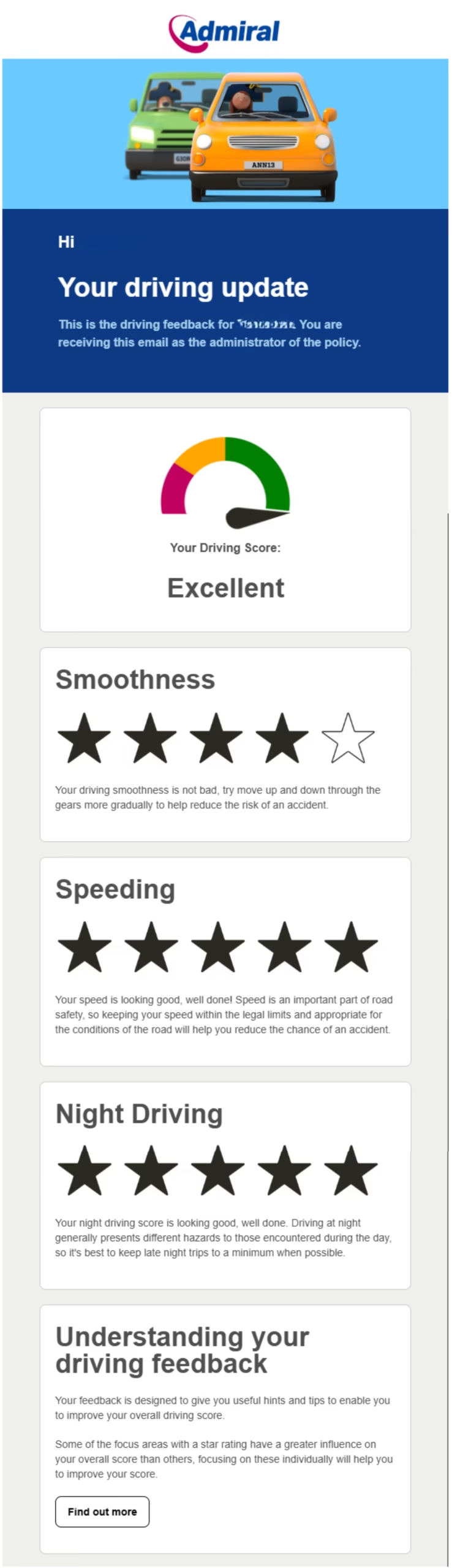

Based on my son’s experience, it is not particularly strict. It’s still early days, but so far my son has received an ‘Excellent’ overall score.

Below are my comments on the three areas that Admiral scores driving:

SPEED – I know my son is a little heavy footed on the accelerator and on a fairly regular basis, goes slightly over speed limits. He might do 35 in a 30 or 80 in a 70. A colleague who knows about cars told me that car speedos generally overstate the true speed. So in fact, he might not actually have been speeding. The Admiral Black Box uses GPS to accurately measure speed.

SMOOTHNESS – I’ve been a passenger with my son on many occasions, and he isn’t what I would class as a smooth driver; he has only been driving for a year. He tends to drive a little too close to the car in front and has to brake more often. He also hasn’t mastered accelerating out of corners, so the car tends to roll a bit.

NIGHT DRIVING – This rating doesn’t seem very accurate. My son rarely drives between 10pm and 4am, yet even when he doesn’t drive during those hours at all, he sometimes only receives 4 out of 5 stars.

Conclusion

For my son, having a black box is a great option. It cuts the premium by a lot and doesn’t come with restrictions. Without it, he wouldn’t have been able to get insured due to the high price of insuring a young driver.

My son has said he is very conscious of the Black Box, which makes him drive sensibly. He doesn’t like being constantly monitored, which I can understand, but the fact that it keeps him in check is a very good thing in my opinion.

Overall, my son feels the Black Box scoring is fair, and from what I’ve seen, I agree. In fact, I’d say the driver scoring is quite lenient (apart from night driving).